Understanding Private Equity

Private Equity involves investing for a period of 3-10 years in private non-listed companies at different stages of their development in order to develop and/or improve their performance.

Why invest in Private Equity, and how?

Investing in non-listed companies meets two objectives: portfolio diversification and investing in assets that are not closely correlated with listed companies.

Private equity investments can be made either directly or via a private equity fund.

Investors can combine both approaches or choose one or the other depending on their expertise, their target risk/reward ratio and the resources they can assign to managing their investment.

What is the best time to invest in Private Equity?

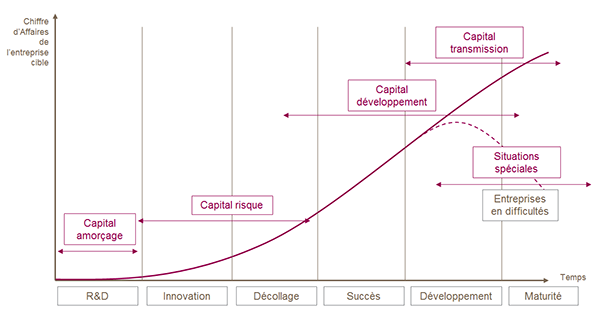

Specialised investment teams with financial, strategic and operational expertise work with the company at each stage in its development.

- Venture capital: investments in start-ups proposing an innovative idea or product,

- Growth equity: providing a business leader with support to achieve their growth strategy with the goal of generating a return over the medium term,

- Buyout: acquisition of a mature company by investors in a financial structure using debt,

- Special situations: Equity financing for companies that have faced difficulties and for which strategic and operational measures have been implemented.

Company life cycle and investment

How does Private Equity create value for investors?

The value of a company is most often measured using an earnings multiple based on its primary activity.

For investors, value creation generally results from:

- Growth in the company’s earnings as a result of the development of its activity, the optimisation of its financial position and productivity gains

- An increase in valuation multiples. As the earnings multiple is generally linked to the size of the company, mergers and acquisitions can impact this multiple.

What is an LBO?

An LBO (Leveraged Buyout) is a financial structure used to purchase a company with part of the acquisition financed by debt.

As the investor repays the debt taken on to finance the acquisition, the value of the investment increases automatically (provided the company’s valuation remains the same or rises).

LBOs are often used by company directors who team up with financial investors to buy out their company when the existing shareholder wishes to sell their stake.

What are the risks involved in Private Equity?

There are several types of risks:

- Risk of capital loss: private equity investments – be they via investment vehicles using private equity strategies or direct investments and co-investments in private equity vehicles – are not guaranteed and investors may lose some or all of the amount they invest.

- Liquidity risk: private equity investments target unlisted companies which are illiquid by definition. The liquidity of private equity investments depends on the possibility of being able to sell unlisted shares quickly. The shares in some collective private equity funds may be subject to a lock-up period during which they cannot be sold. In addition, shares in some funds are not freely transferable and there may be no market for them. No such market is expected to develop. In this case it will be difficult for investors to sell their shares or obtain reliable information about the level of risk incurred.

- Risk related to investments in unlisted companies: investing in unlisted companies is by nature more risky than investing in listed companies because private companies can be smaller and more vulnerable to changes affecting markets and technology as well as being highly dependent on the expertise and commitment of a small management team. Investments in private companies can be difficult to sell. When private equity funds are wound up, the investments may be distributed in such a way that investors may become minority shareholders in several unlisted companies.

- Credit risk: the risk that the issuer of debt securities does not reimburse the debt on time, which will bring down the fund’s net asset value.

- Risk relating to the committed capital: the committed capital is called in stages and the call dates are not known when the commitment is signed. Investors must ensure they have the funds available for capital calls at all times in accordance with the terms of each private equity fund or investment mandate.

What is current state of the Private Equity market?

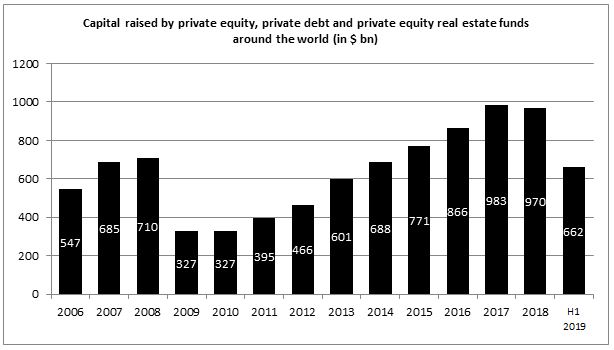

The Private Equity industry has raised record amounts of capital over the past five years.

There is growing investor interest in unlisted assets as the market becomes more mature. The number of companies financed by private equity will probably exceed those listed on the stock market in a few years’ time.

Private Equity remains a market of small and medium-sized enterprises and currently accounts for $3 trillion around the world, double the amount of assets managed by Amundi, or half those managed by the US asset manager BlackRock.

In the first half of the year, private equity and private debt funds raised $662 billion from investors.

Source: Prequin, July 2019

LBO funds (which use debt to invest in unlisted companies) attracted $414 billion in investments over the first nine months of 2019, with the average fund size totalling $471 million, compared with $364 million a year earlier (+29%).

Valuations increased to an average of 10.5 x EBITDA over the first nine months of the year, boosted by low interest rates.

Abundant liquidity is currently creating competition between funds and business owners, which is making fund managers act quickly to identify the most promising sectors. Funds must focus on distinctive criteria (sectors, strategies, regions, etc.) to ensure they invest their capital on good terms and achieve their performance objectives.

December 13, 2019